Opening a Credit Card With My Father Messed Up My Finances For Years

I was lying in bed on a recent Saturday morning when my dad called me yelling about something that’s long been a sore spot between us.

“Why did you go over the limit of your credit card?! Did someone steal it? What’s going on?!” he screamed.

I did a quick mental scan—this was the card that lived in my wallet, but I barely ever touched. I hadn’t used it in ages. I was staying at a friend’s house in Philadelphia for the weekend, and the entire apartment was still asleep. My husband was snoring next to me. I frantically turned down the volume to the lowest notch.

“I’ll handle it,” I half-screamed-half-whispered at him, retreating to the bathroom where I hoped no one could hear our conversation.

When we hung up, I immediately called my credit card company. That’s how I discovered that I’d left the card hooked up to my Uber account for months: all those Pools added up, aggregating beyond my $3,000 limit. So what, right? Just an irresponsible decision on my part; why does my dad need to get involved? I’m 27 and married. I have a graduate degree and a full-time job in New York City. I haven’t lived with my parents since 2009.

The thing is: My father and I share a credit card.

—

My relationship with credit cards started young and with envy: I was jealous of friends in high school wielding their shiny plastic to buy crap at the mall. I tried to sell my parents on letting me open a gas card, but it was a hard no. I didn’t have one college either—my parents said they didn’t want me to get swipe-happy.

At the time I was livid, but looking back I’m starting to understand their perspective: A report published by the American Association for University Women revealed that two-thirds of student loan debt in America is held by women—an estimated $800 billion dollars. And a 2015 National Debt Relief survey showed 63% of women between the ages of 18 to 64 reported have credit card debt, as opposed to only 36% of men. In a way, the odds were stacked against me.

But when I left Florida to go to graduate school in New York City, they finally caved. Because I didn’t have any credit (thanks, guys), my dad offered to open one with me.

Our arrangement was that he would get my statements in the mail and withdraw the money—funded by my student loans—each month from my checking account and handle the bill. The thought was that I’d be too busy with school and adjusting to my new metropolitan life to think about handling that part of my finances. In hindsight, this was a terrible idea.

I swiped my card and put the spending out of mind. Dad was handling the bill. I didn’t need to survey the damage.

Quickly, I started using the credit card for my “big-girl” necessities: a one-way plane ticket from Florida, an iPad for all my class reading that I never actually used, a new desk in the apartment I shared with my boyfriend (now husband) that turned into a collection of clutter. I bought winter coats, hundred-dollar boots; I didn’t think twice about ordering an appetizer while dining out. I justified my purchases as just par for the course after moving to a new place. I swiped my card and put the spending out of mind—I never considered the repercussions of the debt I was accruing. Dad was handling the bill. I didn’t need to survey the damage.

“I’m taking money out of your checking account to pay your credit card bill,” my dad would text me once a month. That system worked until he caught on to just how much I was spending. It started with texts from my father telling me to stop using the card so much. “I have it under control,” I’d write, jabbing my thumbs at the keyboard. This dynamic caused a palpable tension between us, and eventually I decided to cut him out of the process and have the statements sent directly to my Brooklyn address. This only made dad’s text reminders about making timely payments more intense. It never occurred to me that he was worried I could be tanking his credit score.

—

My father has had money anxiety for as long as I can remember, a remnant from his own childhood growing up without a lot of it. He compensated by being hyper-conservative about how he spent and saved. “I’ve always wanted you to have a sense of responsibility to your own debts,” he told me on a recent, less fraught, phone call. I remember him taking me to the bank at 10 years old to open my first savings account.

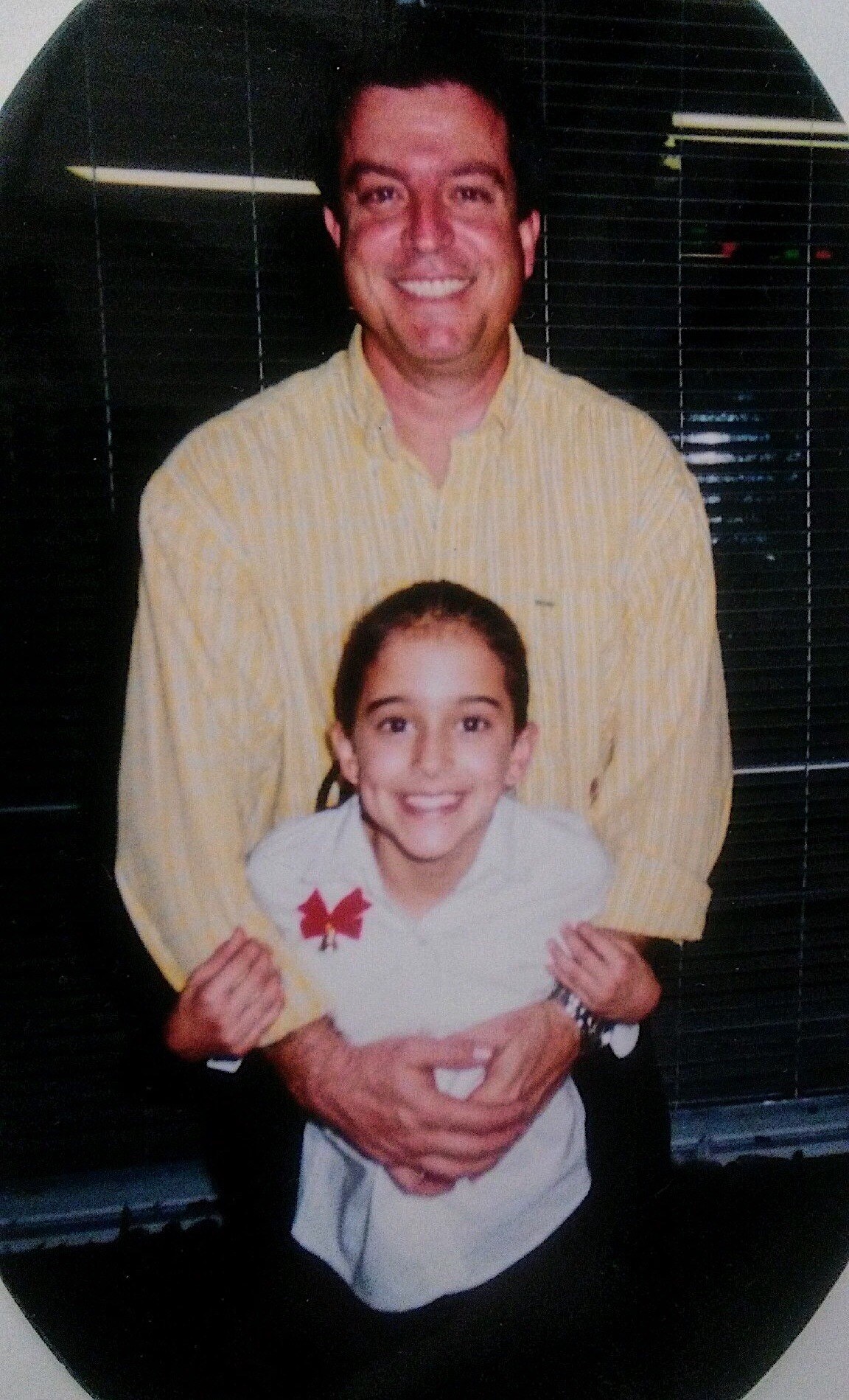

He wanted me to feel the satisfaction of seeing that I had my own money not just sitting in a piggy bank. I’d deposit tooth fairy loot and birthday checks from my grandfather, and my eyes lit up watching the balance grow. He instilled me in the value of earning your own wages throughout my teens, and I had regular jobs at pizza joints and ice cream parlors to pay for gas or buy anything extra.

My dad and I, around the time I opened my first savings account.

I got a full ride to college, and that scholarship money was the first time I’d ever had that much in my accounts. Suddenly, I felt rich. I bought myself Forever 21 blouses and cigarettes—things I wanted at the time but didn’t need. When I got to grad school, it was more of the same; but this time with loans. Really scary, big loans. Only by that point, I was an adult. That was four years ago, and when my dad calls to tell me to rein in my spending or pay my bill I find myself wishing that I could just fail and figure things out on my own. I know I’m lucky to have the safety net. But what if losing it might be the only thing that teaches me how to stand on my own two feet?

—

That morning call in Philadelphia didn’t end well. “Open your own card and transfer the balance. I’m over this and your shit!” my dad fumed before we hung up. It felt harsh, but also like the right move. I don’t want to fight with my dad about money. I am ready to just handle my own financial shit.

When I got home, I started researching cards. The plan is to apply for one with a year of zero percent interest so I can focus on aggressively paying down the $2,800 balance. My husband, who has healthy financial habits and excellent credit, actually suggested that we open a card together—it’s one of those married milestones, and on paper it makes total sense.

But I know that would just put me back in the same comfortable pattern I’m trying to break free from. I don’t want to rely on the men in my life to clean up my finances or make decisions about money. This time I’m going to do it the way I think will work best for me: All on my own.

Jessica Militare is an assistant editor at Glamour.