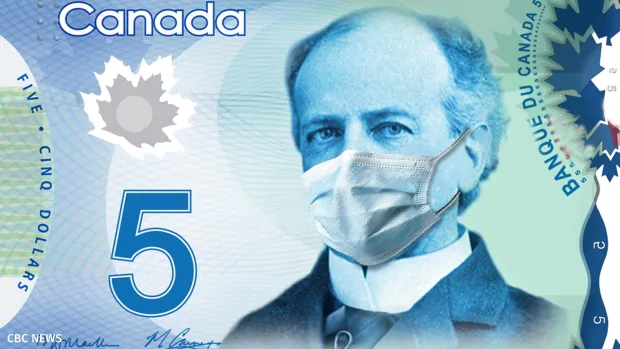

'If you give cash, you get cash' — the payment problem for retailers in the era of COVID-19

Canada’s central bank is urging retailers to continue accepting cash as a form of payment, even as they’re asked to keep physical interactions with customers to a minimum.

The Bank of Canada said Monday that it encourages Canadian consumers and businesses to use whatever form of payment they are most comfortable with to pay for essential purchases.

But the bank also “strongly advocates that retailers continue to accept cash to ensure Canadians have access to the goods and services they need,” it said in a statement.

“Refusing cash purchases outright will put an undue burden on those who depend on cash and have limited payment options.”

Retailers have been put in a bind by the current pandemic, as strict physical distancing rules have caused many of them to temporarily shut down to slow the spread of the coronavirus that causes COVID-19. And those that have been asked to stay open have had to implement all sorts of onerous protocols involving cleaning of surfaces and spaces and keeping physical distance between people in stores as much as possible.

While there is no specific danger from using cash as opposed to any other sort of physical interaction, health authorities around the world are urging people to keep touch to a minimum. That would include handing over bills and coins from one person’s hand to another.

‘Risk can be mitigated’

“We know that [COVID-19] can stick to surfaces for a few hours to a few days, and this may include hard currency,” said Dr. Isaac Bogoch, an infectious diseases physician and scientist with the Toronto General Hospital Research Institute.

But he added: “Risk can be mitigated in retail settings using a variety of methods, including ensuring access to hand hygiene for all employees.”

The Retail Council of Canada represents 45,000 retailers across the country. Spokesman Karl Littler says his members for the most part recognize both sides of the issue and are constantly balancing the need for safety and hygiene against the need to make sure that consumers without other options are able to purchase badly needed supplies.

“We prefer tap for the obvious reasons that it minimizes surface contact. but we recognize that not everybody has a tap function,” he said in an interview.

“At the same time, we have a bunch of unbanked people in our society, and people who live in the cash economy are often some of the most vulnerable.”

Health authorities say there is no specific danger from cash in terms of transmitting the virus that causes COVID-19, as opposed to any other surface. The Bank of Canada notes that unlike the previous generation of Canadian bills which were made of paper, the current version is made of polymer and can therefore be washed with soap and water, which is the best method of deactivating the virus.

Littler notes that cash by its very nature “gets handed from one person to another,” and most cash transactions don’t involve customers paying for their purchase with an exact amount, which presents another problem.