Travelling during the coronavirus outbreak? Here's what you need to know right now

As the coronavirus continues to spread globally, there’s a growing chance that it may affect your travel plans. If you’re booking a trip or contemplating cancelling your current one, here’s what you need to know right now.

Will my insurance cover me?

Many Canadians are discovering that — much to their surprise — their trip cancellation insurance doesn’t provide coverage if they cancel their trip due to fears of the coronavirus.

Generally, travellers who bought regular insurance will only get reimbursed for a coronavirus-related trip cancellation if it was booked before Ottawa issued an advisory against non-essential travel to their destination.

Currently, China, Iran, northern Italy and parts of South Korea are on the federal government’s travel advisory list because they each have high numbers of coronavirus cases.

And a warning: even if your travel destination makes the list, cancellation coverage is no longer guaranteed. In a new development this week, at least two Canadian insurance providers — Manulife and TuGo — have stopped offering coronavirus-related cancellation coverage for new customers.

Trip cancellation insurance is supposed to compensate travellers for unexpected mishaps, and both Manulife and TuGo have now deemed the coronavirus a “known” event that people are well aware of when booking their trips.

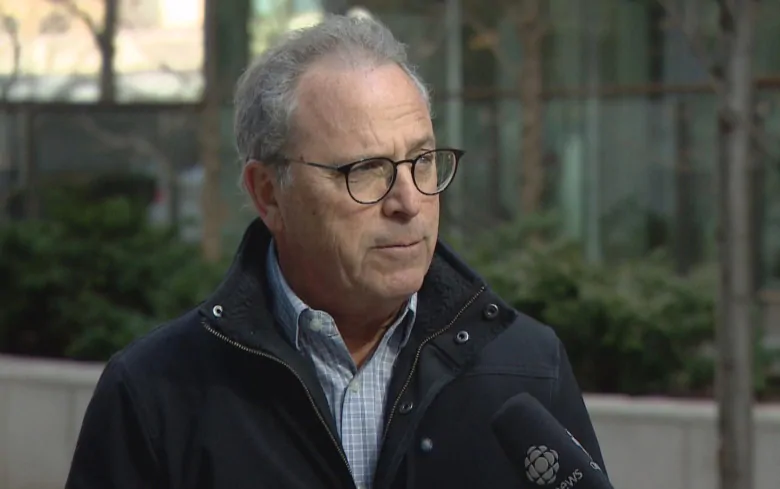

Travel insurance broker Martin Firestone predicts other companies will follow suit, so he advises travellers to investigate just what their insurance will cover before signing up.

“We’re in a very fluid situation right now,” said Firestone, with Travel Secure in Toronto.

For new customers who want a guarantee they’ll still be covered, Orion Travel Insurance — which is owned by the Canadian Automobile Association — pledged on Friday that it will continue to cover coronavirus-related trip cancellations.

Stopovers are included

If you have the right cancellation insurance, Firestone said it will kick in even if a country where you have a layover gets added to the government’s travel advisory list.

“Even a stopover by a plane in one of the affected regions is good enough to trigger the cancel mechanism,” he said. “Just because you were flying in for 10 minutes and landing and not even necessarily getting off the plane, that would have been enough.”

When the government advised against non-essential travel to northern Italy this week, Firestone said that allowed six of his clients to cancel their trip and get a full refund. All six were headed on a cruise that had just one port of call in northern Italy.

“One port did it,” he said. “They were relieved.”

Marjolaine Savoie of Vancouver hoped the same rules would apply to her family’s trip.

Back in August, she booked a vacation for herself, her 11-year-old son and her 72-year-old mother to visit Vietnam during March break.

As the coronavirus spread beyond China, Savoie decided to cancel her trip, concerned about her mother, who already suffers from diabetes and asthma.

“I would never be able to forgive myself if we go and she gets sick.”

Savoie had purchased cancellation insurance and was disappointed when her provider refused to reimburse her for the $2,590 she spent on plane tickets — because Vietnam isn’t on Canada’s travel advisory list.

“Why do we bother buying travel insurance?” said a frustrated Savoie. “I would have expected that they would at least reimburse me a portion of it.”

She pointed out that her flight had a stopover in Taiwan which, according to China, is part of that country. However, while the Canadian government has posted an advisory against non-essential travel to China, Taiwan, which is listed separately, has no travel restrictions.

Added protection

For travellers who want bullet-proof protection, some insurance providers offer a “cancel for any reason” option.

Firestone said he’s not a fan of this option because it’s pricey and won’t cover the full cost of a cancelled trip.

“It’s so outrageously expensive that it just doesn’t make sense.”

He does recommend getting medical insurance while travelling, which Firestone said should still provide coverage if you happen to catch the coronavirus — as long as you’re not visiting a country that’s already on Canada’s travel advisory list.

Another way travellers can protect themselves is to book with a travel provider that offers a flexible cancellation or change policy during the coronavirus outbreak.

Air Canada, WestJet, Air Transat and Sunwing each announced this week that customers who book a flight or, in some cases, a vacation package, for a specific period in March can make changes without paying a change fee.

Some cruise lines are also temporarily revising their cancellation policies. For a period of time, Viking Cruises is waiving cancellation fees for customers and Princess Cruises and Carnival Cruise Line will reimburse any change fees in the form of a future cruise credit.

Carnival is also offering an incentive for passengers to not cancel. According to the company, customers booked on a cruise departing before April 1 will receive up to $200 US in credit to spend on the ship — as long as they don’t change their cruise date.

More travel providers may start loosening their cancellation policies or offering incentives to book right now, so travellers should shop around before booking a trip during these uncertain times.